Gazundering could make a return to the market

Property market could see the return of gazundering

Is is amazing the difference a year makes in the property market. Only 12 months ago the market was so fired up that London house prices were rising at their fastest rate on record and other parts of the UK were not far behind. Since then it seems that buyers have had a reality check and the housing market may see the return of gazundering. This term was invented a few years ago and is the act of ungentlemenly conduct amongst buyers. A buyers waits until they are due to exchange contract on their purchase only to inform the vendor that the purchase price must be negotiated if the sale is to go ahead.

You can imagine the claims of treachery from vendors who accuse the buyer of scheming and that this was their intention all along. Buyers who know that the seller is in a predicament or know that the seller has committed to buying another house will sometimes pull this trick. Of course the seller can tell the buyer to get lost but sometimes they are not in a position to do so. If they have bridging finance on the house they are buying they could be stiffed and a 10k price reduction on the sale of their home may not seem so bad particularly if there is a scarcity of buyers. Buyers could not have got away with this last year but as we say things have changed.

Whilst there is still a shortage of homes coming onto the market in sought after areas which may push up prices in the short term but the the market usually grinds to a halt in an election year as buyers wait to see how any new government will affect them. Rightmove said that it had received a record number of visits to its website in December it is not yet clear whether this will filter through to sales. The Council of Mortgage Lenders also released date showing that lending for mortgages was down by 7% in the quarter to December with much of this being attributed to the Mortgage Market Review that was introduced by the Bank Of England.

The Mortgage Market Review has made it much harder for buyers to get a mortgage because it ensures that lenders are not lending money recklessly and that borrowers can afford the mortgage when interest rates start to go up again. Mortgage checks are much more thorough and borrowers have to include items such as the cost of child care and gym memberships in their monthly budgets. Other items such as take away's and meals out must also b included in monthly budgets that are submitted to the lender before a mortgage can be taken out.

Stamp Duty Savings Yet To Filter Through

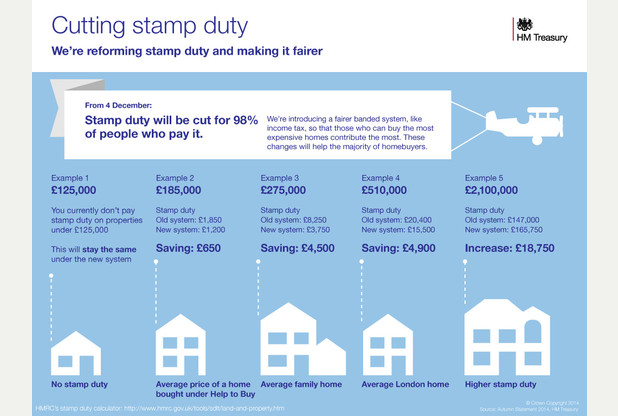

The good news that has yet to filter through yet is the stamp savings that most buyers will benefit from. This is going to help buyers spending up to £935,000 but will have a negative impact on properties across expensive parts of Britain. In London house prices will more than likely be affected because the increase in stamp duty is significant on properties valued at over £1m. Other homeowners that may also fall victim to the gazunderer are those that are selling a home for 2m or more.

There has been a lot of in the press of late regarding the Mansion Tax that the Labour Party and the Liberal Democrats would like to introduce. If this tax were to be introduced it would have a damaging affect on properties worth over 2m and would possibly bring the values of those homes down. Many would argue that this is an unfair tax because many older people are living in homes that have increased dramatically over the last 30 years. These people are not necessarily cash rich but will be forced to pay the Mansion Tax.