Home / Blog

Shortage Of Affordable Homes Across UK

New figures released by the government show that the shortage of affordable homes across the UK is not letting up as our population increases and the UK housing stock

47,000 People Use Help To Buy Scheme

The UK government has released data to show that the just over 47,000 properties have been purchased through the "Help To Buy" scheme. The scheme was introduced just over two years ago and appears to be helping the very buyers it was designed for.

House Prices Already Start To Increase After Election

The UK's largest online property agency has told buyers that they should not put off buying a home because they house prices look as though they will be going up in the short term.

Property Market Sees Buyers Return On Good News Exit Polls

Within about 5 minutes of the exit polls on election day the mobile phones of London's estate agents were ringing. International buyers were panicked and sellers were calling to increase the asking prices of their homes that had previously not been selling.

Fewest Homes For Sale In Six Years

According to experts house prices across London could double over the next 15 years as e struggle to keep up with the demand for more homes. We are already seeing prices increase simply because there is not enough housing

Developers Increase Number Of New Homes Built

According to data just released by the National House Builders Confederation the number of new homes being built increased by 18% between January and March 2015. The numbers will be welcomed by the construction industry

Appetite for buy to let increases as prices rise

As house prices continue to rise so does the wealth of buy to let landlords. Recent figures released by the office for national statistics show that the value of homes owned by private landlords now stands at £1tn

Some Estate Agents Guilty Of Double Fees

If you keep an eye on properties for sale in your area you may have noticed a slight difference in the way that some of them are being marketed. some adverts have appeared where they are suggesting that buyers

Mortgage Lending Jumps In March

The Council Of Mortgage Lenders (CML) has said that mortgage lending jumped in March after subdued couple of months caused by the slump over Christmas. The figures have been welcomed by estate agents and property experts who will want to see the rise in lending continue in order to stave off a downturn.

Generation of renters will finf it harder to buy a home

Generation Of Renters Will Not Be Able Buy

The next few months will be very interesting in the housing market as estate agents welcome pensioners that can now spend their pension pots on buying an investment property. As of from the 6th April 2015 pensioners will be able to decide for themselves

Pensioners looking to get involved in the housing market

Property market will be boosted by pensioners

The next few months will be very interesting in the housing market as estate agents welcome pensioners that can now spend their pension pots on buying an investment property. As of from the 6th April 2015 pensioners will be able to decide for themselves

Property market could see the return of gazundering

Is is amazing the difference a year makes in the property market. Only 12 months ago the market was so fired up that London house prices were rising at their fastest rate on record and other parts of the UK were not far behind. Since then it seems that buyers have had a reality check and the housing market may see the return of gazundering.

Asking Prices Already Start To Rise In 2015

Early reports from estate agents and building societies suggest that the property market has already started with a bang as homeowners already start to hike their asking price and the number of buyers starts to pick up again. Estate agents are already suggesting that 2015 could be a bumper year with buyers.....

Can We Ever Build 250,000 New Homes Every Year

We all know that in order to meet the required demand of new homes we have to build around 250,000 new homes every year. This may seem like a tall order and the government has made significant changes to the planning system to facilitate this but sadly it seems unlikely...

Why rent controls would be pushed by Labour Party

Over the last couple of years we have seen house prices rise to new highs and hotly followed by landlords squeezing every last penny out of their tenants. This has been followed by demands from Ed Milliband and many of this colleagues that the UK rental sector should be subject to rent controls set by local councils. currently rent controls

Halifax report increased number of first time buyers

The Halifax has released data to show that the number of first time buyers had increased over the last 12 months to levels not seen since 2007. The data showed that over 325,000 first time buyers moved last year which was an increase of 22% on the previous 12 months.

Demand for longer term mortgages Increases

The number of homeowners taking out longer term mortgges has doubled over the last 12 months. The main reason for this according to some experts is affordability. Buyers are no longer able to take out interest only mortgages so are instead opting to take out mortgages over 35 years in order to bring their monthly payments down to a more affordable level

Exodus of Londoners to the suburbs

A record number of Londoners moved out of the capital over the last 12 months amid the highest prices on record. Most households moved to areas outside of the capital but within commuting distance of London.

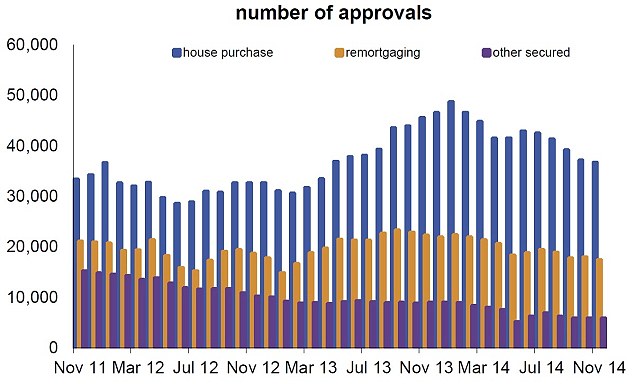

Mortgage approvals drops in November

The number of mortgage approvals has dropped by 20% in the month November compared to the same month last year.

Mortgage approvals drops in November

The number of mortgage approvals has dropped by 20% in the month November compared to the same month last year.

Will more homes be repossessed in 2015?

Figures released today by the Council of Mortgage Lenders show that the number of homes repossessed by the banks is likely to increase in 2015. The latest report comes as the property market appears to be slowing and takes into account the likelihood of interest rate rises next year. There is some disagreement amongst economists over when interest rates may rise........