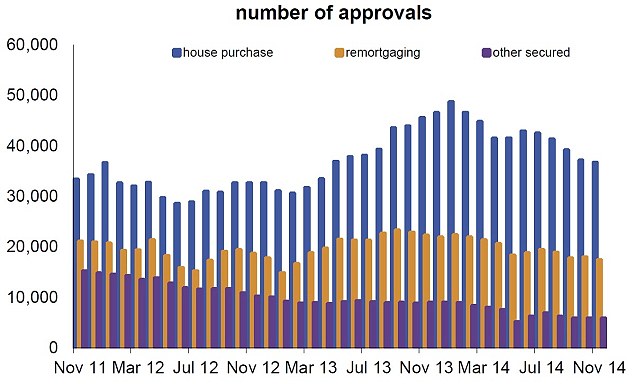

Number of mortgage loans approved falls by 20%

Bankers association shows reduction in loan approvals

A further slowdown down seemed evident in further figures released by the Britiah Bankers Association BB. According to the chief economist at the BBA mortgages approvals were down 20% on the same period last year due to a number of reasons. The reason lull in the housing arket can be put down to a number of factors but top of the list is the Bank of Englands change to mortgage lending rules which were annouced in the summer to curb excessive lending by some lenders. The new rules which tightened up lending criteria has nmade it much harder for some borrowers to obtain a mortgage.

Banks have been far stricter in their lending criteria and borrowers outgoings have been studied much mare carefully to make sure that borrowers can afford mortgage payments. Items such as child care which were previously not taken into consideration by banks have now been included in the monthly outgoings for borrowers which has made a big impact on some borrowers buying power. Other items such as meals out and takeaways has also been taken into account. Banks have been sifting through the bank statements of would be borrowers and looking for other items such as gym membership etc.

Buyers will now have to wisen up and make sure that they think ahead. They will have to make sure that they live well within their means six months prior to applying for a mortgage. The less they have coming out of their bank account on extravagant items the better their chances of getting a mortgage will be. You can't hide items such as child care but you can cut back on take-away's and other luxury items.